Secrets Your Banks Will NEVER Tell You

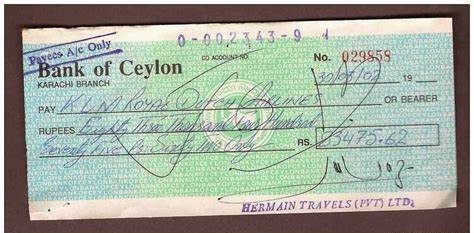

They like it when you bounce a cheque

Image source/ HuffPostThey will never tell you that the cheque you cashed may take them up to around 3 days to actually submit it. And of course, they don't care (in fact they actually like it) if it bounces because they receive around 30 dollars every time this happens...

Image source/ HuffPostThey will never tell you that the cheque you cashed may take them up to around 3 days to actually submit it. And of course, they don't care (in fact they actually like it) if it bounces because they receive around 30 dollars every time this happens...Advertisement

And then they don't pay as much interest...

Image source/ truthoutSo, what a lot of people do to avoid their check bouncing so that they don't pay a fee is they keep excess money in their cheque account. But again, the banks don't mind this strategy either because it means they have to pay less interest on the money in your real account. It's a win-win for the banks...

Image source/ truthoutSo, what a lot of people do to avoid their check bouncing so that they don't pay a fee is they keep excess money in their cheque account. But again, the banks don't mind this strategy either because it means they have to pay less interest on the money in your real account. It's a win-win for the banks...Advertisement

Overdrafts are beneficial for the banks

Image source/ richardcayneIf you've had an overdraft, you may have felt like the bank was doing you some kind of favour or been tricked into feeling like it is somehow free money. Yet, it suits them more than us because of the interest they get on it and the fee they charge every time you accidentally slip over it...

Image source/ richardcayneIf you've had an overdraft, you may have felt like the bank was doing you some kind of favour or been tricked into feeling like it is somehow free money. Yet, it suits them more than us because of the interest they get on it and the fee they charge every time you accidentally slip over it...Advertisement

You may not actually need to pay fees

Image source/ HuffPostSometimes a bank will charge you for something such as an overdue overdraft etc or as we have discussed, a bounced cheque. And of course, as long as it is not major...you may not have to pay it at all. Often, we assume there's no getting out of it but especially if you are a long-term customer, it's worth giving them a ring because the majority of the time you can get it waived.

Image source/ HuffPostSometimes a bank will charge you for something such as an overdue overdraft etc or as we have discussed, a bounced cheque. And of course, as long as it is not major...you may not have to pay it at all. Often, we assume there's no getting out of it but especially if you are a long-term customer, it's worth giving them a ring because the majority of the time you can get it waived.Advertisement

Double check your debit card protection

Image source/ HarparsbazaarAsk your bank about the protection around your debit card when it is either lost or stolen because in a lot of cases shockingly, you could have thousands of dollars taken and there is no real protection. No way near as much as if you have a credit card.

Image source/ HarparsbazaarAsk your bank about the protection around your debit card when it is either lost or stolen because in a lot of cases shockingly, you could have thousands of dollars taken and there is no real protection. No way near as much as if you have a credit card.Advertisement

The Universal Default clause

Image source/ PinterestIf you sign up for a credit card and this is in the clause...then don't sign. Or at least make yourself of what it means. Because it means that they can snoop through all of your cards to see whether you are overdue any bills and are late at all. Then the price will ramp up. This is why they say always read before you sign...

Image source/ PinterestIf you sign up for a credit card and this is in the clause...then don't sign. Or at least make yourself of what it means. Because it means that they can snoop through all of your cards to see whether you are overdue any bills and are late at all. Then the price will ramp up. This is why they say always read before you sign...Advertisement

Online banking safety

Image source/ PinterestIt's not that online banking is unsafe...it's just that some studies have shown that the online banking sites sometimes redirect you to other sites that definitely aren't the most safe or trustable. Which is not what you expect when handling money is involved.

Image source/ PinterestIt's not that online banking is unsafe...it's just that some studies have shown that the online banking sites sometimes redirect you to other sites that definitely aren't the most safe or trustable. Which is not what you expect when handling money is involved.Advertisement

The bank has the right to take from your account

Image source/ TaxassistaccountsIf you have any outstanding fees or overdrafts to pay, the bank is allowed to just take this right out of your account without your approval or anything. Essentially, if you do borrow from the bank ensure you can pay it back on time or you may end up in more up a tricky situation.

Image source/ TaxassistaccountsIf you have any outstanding fees or overdrafts to pay, the bank is allowed to just take this right out of your account without your approval or anything. Essentially, if you do borrow from the bank ensure you can pay it back on time or you may end up in more up a tricky situation.Advertisement

They don't like lending to charities

Image source/ ChurhblogspIf non-profit organisations or even places of worship want to get a loan, they may find it difficult. The reason is nothing to do with the eligibility of the loan, it is to do with how bad they may appear in the public's perception when they try and get their money back.

Image source/ ChurhblogspIf non-profit organisations or even places of worship want to get a loan, they may find it difficult. The reason is nothing to do with the eligibility of the loan, it is to do with how bad they may appear in the public's perception when they try and get their money back.Advertisement

Some insurance is pretty useless

Advertisement

They have to try and sell new accounts to you

Image source/ HuffPostOne of the main jobs of a teller is to try and encourage new bank services to you. In fact, banks hire mystery customers to tell whether tellers are doing just that. So, they will then report back on how the teller performed and whether they tried to cross-sell.

Image source/ HuffPostOne of the main jobs of a teller is to try and encourage new bank services to you. In fact, banks hire mystery customers to tell whether tellers are doing just that. So, they will then report back on how the teller performed and whether they tried to cross-sell.Advertisement

Your bank might not be the best place to invest

Image source/ trilogyfundNow this is something your bank will definitely not want you to know...and will CERTAINLY not tell you. But the bank is often not the place for you to be investing your money because often we do not earn a lot of interest whereas there are investments where our money would be making us a lot more.

Image source/ trilogyfundNow this is something your bank will definitely not want you to know...and will CERTAINLY not tell you. But the bank is often not the place for you to be investing your money because often we do not earn a lot of interest whereas there are investments where our money would be making us a lot more.Advertisement

They hate bags of loose change

Image source/ RedditThe banks really don't enjoy receiving bags of loose change. When someone walks in with a clear plastic bag full of loose change the banks' reaction is...oh no. Not only is it usually not so much money but also tit takes a lot of time and effort to count it all up. They prefer rolled coins and money wrappers instead.

Image source/ RedditThe banks really don't enjoy receiving bags of loose change. When someone walks in with a clear plastic bag full of loose change the banks' reaction is...oh no. Not only is it usually not so much money but also tit takes a lot of time and effort to count it all up. They prefer rolled coins and money wrappers instead.Advertisement

Always keep ATM receipts

Image source/ simpleinterestSometimes we put way too much trust in our ATM's considering it is just a machine. And if we've all had a phone or a laptop, we know they aren't always 100% reliable. So why assume the ATM is? Check you are receiving the right amount of money you put in / take out and keep proof.

Image source/ simpleinterestSometimes we put way too much trust in our ATM's considering it is just a machine. And if we've all had a phone or a laptop, we know they aren't always 100% reliable. So why assume the ATM is? Check you are receiving the right amount of money you put in / take out and keep proof.Advertisement

Everything is in their interest

Image source/ marketbankthey may even put on a sympathetic ear to your worries and money woes, they will then offer something that they make sound like they are helping you or doing you a favour. Remember, it is not. It is entirely for them and their own interests. Banks do not do favours.

Image source/ marketbankthey may even put on a sympathetic ear to your worries and money woes, they will then offer something that they make sound like they are helping you or doing you a favour. Remember, it is not. It is entirely for them and their own interests. Banks do not do favours.Advertisement

Banks sometimes do not promote their higher interest accounts

Image source/ interinterestDon't think that banks will always tell you the best offers. If they already see that you are willing to settle for an account with a lesser interest rate, then why would they promote you a higher one and lose out on some money? Banks think in terms of their own interest and never yours.

Image source/ interinterestDon't think that banks will always tell you the best offers. If they already see that you are willing to settle for an account with a lesser interest rate, then why would they promote you a higher one and lose out on some money? Banks think in terms of their own interest and never yours.Advertisement

Your mortgage earns them a lot of money

Image source/ HuffPostIt's not the nicest thought that your mortgage is making bankers money. Paying off your mortgage is not just slowly paying off your house on your own terms. It is making the bank a lot of money because you end up paying a lot of interest for your mortgage.

Image source/ HuffPostIt's not the nicest thought that your mortgage is making bankers money. Paying off your mortgage is not just slowly paying off your house on your own terms. It is making the bank a lot of money because you end up paying a lot of interest for your mortgage.Advertisement

Always read the small print

Image source/ PinterestHow many times have we heard that we should do this? Too many. How many times do we actually do this? Erm... let's just say that it is a lot less than we should do. But it is super important because there can be things that will definitely not be in our best interests hidden in there.

Image source/ PinterestHow many times have we heard that we should do this? Too many. How many times do we actually do this? Erm... let's just say that it is a lot less than we should do. But it is super important because there can be things that will definitely not be in our best interests hidden in there.Advertisement

Always put you ATM cash in an envelope

Image source/ blogspotThe ATM machines do not just give you money you can also put it into your bank. But some people do not put it in an envelope first.... Please don't do that. You may not actually end up with the money in your bank and nobody wants to be frittering away money.

Image source/ blogspotThe ATM machines do not just give you money you can also put it into your bank. But some people do not put it in an envelope first.... Please don't do that. You may not actually end up with the money in your bank and nobody wants to be frittering away money.Advertisement

Not everyone gets the same rates that have been advertised

Image source/ blog.sfgWhen you go to your bank you have to be aware of your options and be a little bit forward in getting the best rates that you can. Because at the end of the day, for the bank the less they can offer you the better. So, they may not be forthcoming about giving you the best rates. Especially if you have a bad credit rating.

Image source/ blog.sfgWhen you go to your bank you have to be aware of your options and be a little bit forward in getting the best rates that you can. Because at the end of the day, for the bank the less they can offer you the better. So, they may not be forthcoming about giving you the best rates. Especially if you have a bad credit rating.Advertisement

You will be offered things you don't need

Image source/ teachooBanks and employees are under pressure because bank employees have targets to hit. So, you may find yourself being offered a lot of things that you don't need. Don't get sucked in and actually take the time to work out if the offer suits YOU not just them.

Image source/ teachooBanks and employees are under pressure because bank employees have targets to hit. So, you may find yourself being offered a lot of things that you don't need. Don't get sucked in and actually take the time to work out if the offer suits YOU not just them.Advertisement

The reason the teller line is always long

Image source/ cashbackNot everybody can or is allowed to do the tellers job. So, when you're stood in line waiting for ages and you can see other staff who could help it is not that they are ignoring you there probably is just one teller in the building, and they must be busy at that moment.

Image source/ cashbackNot everybody can or is allowed to do the tellers job. So, when you're stood in line waiting for ages and you can see other staff who could help it is not that they are ignoring you there probably is just one teller in the building, and they must be busy at that moment.Advertisement

Bankers have reported being very stressed

Image source/ trilogytesBank employees have been reporting that they are feeling increasingly stressed due to the pressures they have to hit deadlines and make money. So, a lot of bank employees have been found to have to take time off work due to them suffering from stress or anxiety.

Image source/ trilogytesBank employees have been reporting that they are feeling increasingly stressed due to the pressures they have to hit deadlines and make money. So, a lot of bank employees have been found to have to take time off work due to them suffering from stress or anxiety.Advertisement

Paying your debt off early can cost you more

Image source/ standard.co.ukIt sounds like you'd be doing yourself a favour and the banks a favour by paying off your debt early. But in reality, they may make you pay a fee for paying it earlier than scheduled. This is probably because they will not be able to take the interest from you for as long.

Image source/ standard.co.ukIt sounds like you'd be doing yourself a favour and the banks a favour by paying off your debt early. But in reality, they may make you pay a fee for paying it earlier than scheduled. This is probably because they will not be able to take the interest from you for as long.Advertisement

You may get a penalty when you sell your house

Image source/ ananplanIf you are making a move and selling your house, you may be hit with a penalty. This is because you broke your mortgage, and so again the banks do not seem to like it when our paying interest has come to an end. So, instead they give us a fee to make up for their losses.

Image source/ ananplanIf you are making a move and selling your house, you may be hit with a penalty. This is because you broke your mortgage, and so again the banks do not seem to like it when our paying interest has come to an end. So, instead they give us a fee to make up for their losses.Advertisement

Fraud is increasingly common within banks

Image source/ RedditData theft, as well as fraudulent transfers and fake debit cards are becoming more and more of a problem withing banks. Not people outside of the banks (well that too) but inside the banks amongst employees who do not feel they are paid enough and turn to crime.

Image source/ RedditData theft, as well as fraudulent transfers and fake debit cards are becoming more and more of a problem withing banks. Not people outside of the banks (well that too) but inside the banks amongst employees who do not feel they are paid enough and turn to crime.Advertisement

Try not to use your debit card while abroad

Image source/ RDUsing your debit card abroad is usually not a good idea if you can help it. Try withdrawing cash instead and preferably before you get abroad. Otherwise, you are hit with charges for every transaction that are way more than usual due to being in a different country.

Image source/ RDUsing your debit card abroad is usually not a good idea if you can help it. Try withdrawing cash instead and preferably before you get abroad. Otherwise, you are hit with charges for every transaction that are way more than usual due to being in a different country.Advertisement

Your bank can freeze your assets with no warning

Image source/ PinterestBanks have so much power. They are massive instructions, and they control the majority of money. So, they also have power over our accounts. They can even freeze the accounts and assets or close it at any point, with no warning at all to the customer.

Image source/ PinterestBanks have so much power. They are massive instructions, and they control the majority of money. So, they also have power over our accounts. They can even freeze the accounts and assets or close it at any point, with no warning at all to the customer.Advertisement

Standards accounts are best

Image source/blogspotIt is the advice by certain money experts that standard accounts may be better than any others because in actual fact the 'perks' that come with other accounts, we actually end up paying more money for them. So maybe avoid the fills and stick to a standard account.

Image source/blogspotIt is the advice by certain money experts that standard accounts may be better than any others because in actual fact the 'perks' that come with other accounts, we actually end up paying more money for them. So maybe avoid the fills and stick to a standard account.Advertisement

Credit unions treat people better

Image source/ readersdigestBanks actually may not be the best place to store our money at all. In fact, it is definitely good to assess all the different options out there before trusting our hard-earned savings with a certain institution. Some people believe credit unions are much more moral and treat customers better.

Image source/ readersdigestBanks actually may not be the best place to store our money at all. In fact, it is definitely good to assess all the different options out there before trusting our hard-earned savings with a certain institution. Some people believe credit unions are much more moral and treat customers better.Advertisement

Bank Investors are sometimes involved in human rights abuse

Image source/ thepowerplayersBanks have a lot of very wealthy investors, but these investors are not checked in terms of whether they comply with human rights or do not partake in any immoral activities. Many are complicit in sending money to practices which go against any human rights.

Image source/ thepowerplayersBanks have a lot of very wealthy investors, but these investors are not checked in terms of whether they comply with human rights or do not partake in any immoral activities. Many are complicit in sending money to practices which go against any human rights.Advertisement

They are protected by the banks

Image source/ fineartamericaBecause the banks do not want these investors to stop giving them masses and masses of money, they fight back against those who try and out their secrets. For example, one company was involved in dumping huge amounts of toxic waste, but the backlash was also met with a strong reaction from the bank.

Image source/ fineartamericaBecause the banks do not want these investors to stop giving them masses and masses of money, they fight back against those who try and out their secrets. For example, one company was involved in dumping huge amounts of toxic waste, but the backlash was also met with a strong reaction from the bank.Advertisement

Administrating deposits last

Image source/ assetssearchblogBanks can be sneaky in how they do things. You may cash in a deposit one day, knowing that you have fees about to come out. However, because they add your deposits afterwards, you could end up in your overdraft because the money hasn't gone into your account yet.

Image source/ assetssearchblogBanks can be sneaky in how they do things. You may cash in a deposit one day, knowing that you have fees about to come out. However, because they add your deposits afterwards, you could end up in your overdraft because the money hasn't gone into your account yet.Advertisement

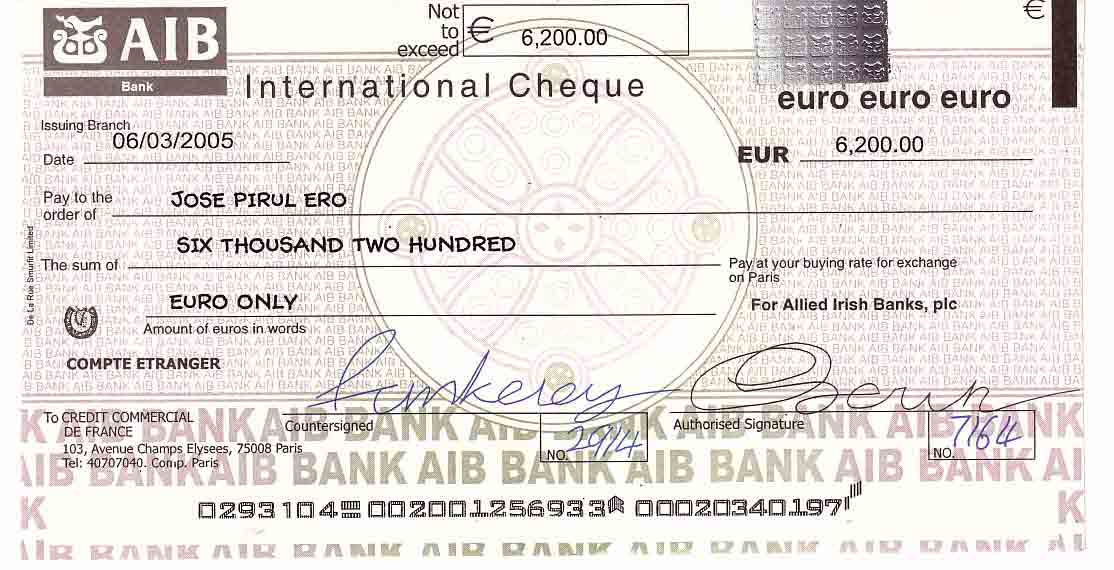

It's the same with cheques

Image source/ blogspotSometimes having a cash actually go into your account can take a while. We all know the banks reasoning - to make sure it is legitimate. But really, it's so that it's more likely you fall into your overdraft when your fees come out and then you end up paying another overdraft fee too.

Image source/ blogspotSometimes having a cash actually go into your account can take a while. We all know the banks reasoning - to make sure it is legitimate. But really, it's so that it's more likely you fall into your overdraft when your fees come out and then you end up paying another overdraft fee too.Advertisement

Don't bother with the online forms

Image source/ naxuriThis thing is with the online forms is that there is no room to manoeuvre. There are standardised procedures. So, if you want some wiggle room or something to be sorted for you according to your personal circumstance it is much better you go and visit a branch.

Image source/ naxuriThis thing is with the online forms is that there is no room to manoeuvre. There are standardised procedures. So, if you want some wiggle room or something to be sorted for you according to your personal circumstance it is much better you go and visit a branch.Advertisement

They can increase your credit limit in branch

Image source/ theclinicalenquirerIn person they can and usually will do it very easily. So, if you need 200 pound and only have 100 the teller can put that extra 100 dollars into your bank to increase your credit limit. But of course, this option is available in person and not online.

Image source/ theclinicalenquirerIn person they can and usually will do it very easily. So, if you need 200 pound and only have 100 the teller can put that extra 100 dollars into your bank to increase your credit limit. But of course, this option is available in person and not online.Advertisement

The bank benefits from online transactions

Image source/ NewYorkTimesIf you wanted to support small shops more than the best way to do it is to pay cash. This is because every time you swipe or insert your card to pay, the retailer will pay a fee to the bank for processing the transaction. This is why some places have a minimal spend on card.

Image source/ NewYorkTimesIf you wanted to support small shops more than the best way to do it is to pay cash. This is because every time you swipe or insert your card to pay, the retailer will pay a fee to the bank for processing the transaction. This is why some places have a minimal spend on card.Advertisement

You need debt history

Image source/ guruinabottleIt seems strange that you need to borrow from the bank to be able to borrow in the futire or make huge investments such as take out a mortgage. So, in actual fact it is beneficial for you to have a credit card which you pay back regularly so that the bank know you are a trustworthy borrower.

Image source/ guruinabottleIt seems strange that you need to borrow from the bank to be able to borrow in the futire or make huge investments such as take out a mortgage. So, in actual fact it is beneficial for you to have a credit card which you pay back regularly so that the bank know you are a trustworthy borrower.Advertisement

Your bank can order your fees

Image source/ PinterestThis means that some banks will put your transactions of the day in an order, for example from high to low. Which is worse off for those who accidentally slip into an unarranged overdraft who may end up getting charged more because of this bank method.

Image source/ PinterestThis means that some banks will put your transactions of the day in an order, for example from high to low. Which is worse off for those who accidentally slip into an unarranged overdraft who may end up getting charged more because of this bank method.Advertisement

Closing a credit card without using it may be detrimental

Image source/ wordpressClosing a credit card without actually having used it can actually hurt your credit rating score, rather than being a sensible move on your part. So be careful if you do this because you may actually be harming your chances of getting an application approved in the future.

Image source/ wordpressClosing a credit card without actually having used it can actually hurt your credit rating score, rather than being a sensible move on your part. So be careful if you do this because you may actually be harming your chances of getting an application approved in the future.Advertisement

Your mortgage can increase even if the rates don't

Image source/ blogspotThis is something you should definitely check before approving a mortgage because sometimes your mortgage can increase even if your rates don't. This is when your mortage may not be tied to the central bank and so may change regardless of the central rate.

Image source/ blogspotThis is something you should definitely check before approving a mortgage because sometimes your mortgage can increase even if your rates don't. This is when your mortage may not be tied to the central bank and so may change regardless of the central rate.Advertisement

Additional mortgage fees

Image source/ TheIndependentThere are sometimes a lot of hidden and sneaky charges that you end up paying alongside your mortage. This may be nothing to do with the interest rate, but things like an exit charge or administration charges which you may have to pay without realising before.

Image source/ TheIndependentThere are sometimes a lot of hidden and sneaky charges that you end up paying alongside your mortage. This may be nothing to do with the interest rate, but things like an exit charge or administration charges which you may have to pay without realising before.Advertisement

They rely on our laziness

Image source/ bankbaynoetBanks have much better deals than the most of us are getting because we stick with what we have not wanting or knowing how to shop around to switch to a better deal. So, it is definitely worth taking the time or giving the bank a call to see what other offers are out there.

Image source/ bankbaynoetBanks have much better deals than the most of us are getting because we stick with what we have not wanting or knowing how to shop around to switch to a better deal. So, it is definitely worth taking the time or giving the bank a call to see what other offers are out there.Advertisement

No loyalty

Image source/ HuffPostUnless you provide the bank with a lot of money, they won't show you any loyalty despite what they say. Rather than customers who have banked with a certain bank for a while being given an upgrade - those best deals are saved for new customers to lure them into the bank.

Image source/ HuffPostUnless you provide the bank with a lot of money, they won't show you any loyalty despite what they say. Rather than customers who have banked with a certain bank for a while being given an upgrade - those best deals are saved for new customers to lure them into the bank.Advertisement

The deals they lure you in with may be slashed

Image source/ readersarchitectGreat - a fantastic deal I'll switch bank. It all sounds pretty good when you are a new customer being offered the best current rate or deal. But what you might not realise is that once they have you as a customer, they may stop the deal later on. Be sure to keep up with it.

Image source/ readersarchitectGreat - a fantastic deal I'll switch bank. It all sounds pretty good when you are a new customer being offered the best current rate or deal. But what you might not realise is that once they have you as a customer, they may stop the deal later on. Be sure to keep up with it.Advertisement

Don't change currency at the bank

Image source/ vin ceperfettoBanks are there to make as much money as possible, not to give you the best deal. Rather than changing your currency at the back try a specialist place designed for currency which will usually offer better rates than the bank will give you. It's worth shopping around.

Image source/ vin ceperfettoBanks are there to make as much money as possible, not to give you the best deal. Rather than changing your currency at the back try a specialist place designed for currency which will usually offer better rates than the bank will give you. It's worth shopping around.Advertisement

The 0% interest cards aren't for our benefit

Image source/ debthunchYes, they may help us. But it's not out of the goodness of the banks' heart that is for sure. They offer these 0% interest credit cards to try and get us to sign up and then when the offer comes to an end, they hope we slip up and end up having to pay extra fees.

Image source/ debthunchYes, they may help us. But it's not out of the goodness of the banks' heart that is for sure. They offer these 0% interest credit cards to try and get us to sign up and then when the offer comes to an end, they hope we slip up and end up having to pay extra fees.Advertisement

They like us to make mistakes

Image source/ readersdigestThe banks love it when we make mistakes. When we forget payments, slip into our overdraft - anything of the sort which ends up that we have to pay extra fees to the bank. It sounds cruel wanting us to be mistaken out of our hard-earned cash, but it's sadly the case.

Image source/ readersdigestThe banks love it when we make mistakes. When we forget payments, slip into our overdraft - anything of the sort which ends up that we have to pay extra fees to the bank. It sounds cruel wanting us to be mistaken out of our hard-earned cash, but it's sadly the case.Advertisement

Opt for a fixed rate mortgage

Image source/ notonlymortgagesFixed rates mean that it is the ban that ends up taking the risk of the rising interest fees and not us. And let's face it, the banks can afford to take the slack better than us. Variable mortgages open yourself up to the risk of paying extra money if the rates go up.

Image source/ notonlymortgagesFixed rates mean that it is the ban that ends up taking the risk of the rising interest fees and not us. And let's face it, the banks can afford to take the slack better than us. Variable mortgages open yourself up to the risk of paying extra money if the rates go up. Advertisement