Here’s How to Become Rich In 1 Year

1. Think About That Gym Membership

Image source Pinterest

In January you vow to start hitting the gym, but by the time March comes round you end up walking to the pub to get your steps in! If you are going to join a gym, make sure you can cancel at any time and not be tied in - otherwise that direct debit will end up costing you £750 a year or more for nothing.Advertisement

2. Clear Out Your Wardrobe

Image source Daily MirrorOur wardrobes are likely to be squashed full of clothes, often dating back to a time when they are about to become fashionable again! So, why not sort those rails out and stick stuff on eBay or a similar site? You'll be surprised at how much money you could make. Alternatively, adapt a dress you are fed up of wearing by dying and customising it!

Image source Daily MirrorOur wardrobes are likely to be squashed full of clothes, often dating back to a time when they are about to become fashionable again! So, why not sort those rails out and stick stuff on eBay or a similar site? You'll be surprised at how much money you could make. Alternatively, adapt a dress you are fed up of wearing by dying and customising it!Advertisement

3. Take your Lunch To Work

Image source The GuardianDon't be lazy! The night before work, make up your lunch for the following day. Include healthy snacks in your Tupperware box to stop you getting a mid afternoon slump in the office from having an earlier sugar rush. You can save yourself at least £25 a week from not queuing up at Greggs for a meal deal. Because you'll be more energised from eating well, your work ethic will improve enough to hopefully get you a pay increase from your boss - it's a win win situation!

Image source The GuardianDon't be lazy! The night before work, make up your lunch for the following day. Include healthy snacks in your Tupperware box to stop you getting a mid afternoon slump in the office from having an earlier sugar rush. You can save yourself at least £25 a week from not queuing up at Greggs for a meal deal. Because you'll be more energised from eating well, your work ethic will improve enough to hopefully get you a pay increase from your boss - it's a win win situation!Advertisement

4. Do A Car Boot Sale

Image source Secret LondonYou know the saying one man's trash is another man's treasure; be ruthless and have a good sort out of ANYTHING you don't want to keep any more. Even ask family and friends if they have any unwanted items. Do a local car boot sale (don't waste petrol on driving a long distance) on a day when the weather is decent. That will bring the crowds to your stall. Sell your unwanted stuff cheaply as you don't want to have to bring it home again. You will be amazing how much you can make on a Sunday morning outing and you can drive home with a empty car and your pockets filled with cash.

Image source Secret LondonYou know the saying one man's trash is another man's treasure; be ruthless and have a good sort out of ANYTHING you don't want to keep any more. Even ask family and friends if they have any unwanted items. Do a local car boot sale (don't waste petrol on driving a long distance) on a day when the weather is decent. That will bring the crowds to your stall. Sell your unwanted stuff cheaply as you don't want to have to bring it home again. You will be amazing how much you can make on a Sunday morning outing and you can drive home with a empty car and your pockets filled with cash.Advertisement

5. Cook In Batches

Image source CookworksWith electricity and gas prices going through the roof, this handy tip makes even more sense. When you're making a shepherds pie for dinner, make another couple for the freezer - saves time and money. Alternatively, if you are cooking minced beef, why not buy a larger quantity (which works out at better value) and make meatballs, a chilli, burgers and a lasagne. You've then got meals in the fridge for another day or put them in the freezer.

Image source CookworksWith electricity and gas prices going through the roof, this handy tip makes even more sense. When you're making a shepherds pie for dinner, make another couple for the freezer - saves time and money. Alternatively, if you are cooking minced beef, why not buy a larger quantity (which works out at better value) and make meatballs, a chilli, burgers and a lasagne. You've then got meals in the fridge for another day or put them in the freezer.Advertisement

6. Make The Reduced Counter Your Friend

Image source Skint DadIf you visit your local supermarket or its smaller 'Local' or 'Express' stores, you will soon find out the times they reduce short dated food. You'll also be able to find out exactly when the price is slashed right down a further 80%. You can either put your bargain purchases in the freezer or make up a meal for the following day. Remember that the date on the packaging is only a guide and will safely last a few days longer than recommended

Image source Skint DadIf you visit your local supermarket or its smaller 'Local' or 'Express' stores, you will soon find out the times they reduce short dated food. You'll also be able to find out exactly when the price is slashed right down a further 80%. You can either put your bargain purchases in the freezer or make up a meal for the following day. Remember that the date on the packaging is only a guide and will safely last a few days longer than recommendedAdvertisement

7. Use A Change Jar

Image source Daily MailAnything less than a pound coin should be put into a change jar. Keep it in your kitchen so you can do it straight away when you get home. Only open the jar when it's full and I can guarantee you will have at least £50 or more in there. Spend it on something you really want without dipping into your wages or put it in a savings account.

Image source Daily MailAnything less than a pound coin should be put into a change jar. Keep it in your kitchen so you can do it straight away when you get home. Only open the jar when it's full and I can guarantee you will have at least £50 or more in there. Spend it on something you really want without dipping into your wages or put it in a savings account.Advertisement

8. Have A 'Clothes Swap' Party

Image source Style ClinicHow about gaining a new section of clothing for your wardrobe combined with a few cheeky glasses of wine! Organise a clothes swap party where no money changes hands, purely a free swap. Turn it into a social event with some alcohol (everyone can chip in on a large bottle of wine that's on special offer). Besides saving money, you are also helping to save the planet by not getting rid of clothes that would end up in landfill.

Image source Style ClinicHow about gaining a new section of clothing for your wardrobe combined with a few cheeky glasses of wine! Organise a clothes swap party where no money changes hands, purely a free swap. Turn it into a social event with some alcohol (everyone can chip in on a large bottle of wine that's on special offer). Besides saving money, you are also helping to save the planet by not getting rid of clothes that would end up in landfill.Advertisement

9. Focus Groups

Image source IntoTheMindsRegister online with a focus group, also known as market research. You will be paid up to £80 for a 2 hour session where all you have to do is express your opinions on various products. You may have to travel to a nearby venue to take part but many are on zoom so you don't even need to leave the house.

Image source IntoTheMindsRegister online with a focus group, also known as market research. You will be paid up to £80 for a 2 hour session where all you have to do is express your opinions on various products. You may have to travel to a nearby venue to take part but many are on zoom so you don't even need to leave the house.Advertisement

10. Use Apps To Track Finances

Image source MessappsYou probably know roughly how much you spend each month. There will be the regular direct debits such as mortgage or rent, council tax, energy, insurance, food and travel. expenses. However you can download one of the many apps, free of charge, to list your income and outgoings . When you can see it in black and white you feel more in control and are less likely to slip into that overdraft at the end of the month. If it's an unauthorised overdraft it could cost you up to £25 for each transaction.

Image source MessappsYou probably know roughly how much you spend each month. There will be the regular direct debits such as mortgage or rent, council tax, energy, insurance, food and travel. expenses. However you can download one of the many apps, free of charge, to list your income and outgoings . When you can see it in black and white you feel more in control and are less likely to slip into that overdraft at the end of the month. If it's an unauthorised overdraft it could cost you up to £25 for each transaction.Advertisement

11. Contact Your Internet Provider

Image source Cable.co.ukMost people organise their internet and tv channel provider when they move into a property. You'll receive letters every couple of years about increases and which say not to worry as the provider will adjust your direct debit and you need do nothing. Well don't 'do nothing'. Check out exactly what you are paying for. Do you really need that tv package now the kids no longer watch CBeebies or do you mainly watch one of the great series' on Netflix? Contact the provider and cancel what you don't need. You could save around £20 a month.

Image source Cable.co.ukMost people organise their internet and tv channel provider when they move into a property. You'll receive letters every couple of years about increases and which say not to worry as the provider will adjust your direct debit and you need do nothing. Well don't 'do nothing'. Check out exactly what you are paying for. Do you really need that tv package now the kids no longer watch CBeebies or do you mainly watch one of the great series' on Netflix? Contact the provider and cancel what you don't need. You could save around £20 a month.Advertisement

12. Transfer Debts to a 0% Credit Card

Image source Debt.comSome credit card companies charge an extortionate interest rate and you might not even notice as you pay £50 a month regardless. Out of that £50, £15 could be interest so you will be paying the debt off for longer than you thought. Change to one of the many credit cards that offer a zero percent rate for 2 years and aim to have the amount paid off by that duration. That is a heck of a saving.

Image source Debt.comSome credit card companies charge an extortionate interest rate and you might not even notice as you pay £50 a month regardless. Out of that £50, £15 could be interest so you will be paying the debt off for longer than you thought. Change to one of the many credit cards that offer a zero percent rate for 2 years and aim to have the amount paid off by that duration. That is a heck of a saving.Advertisement

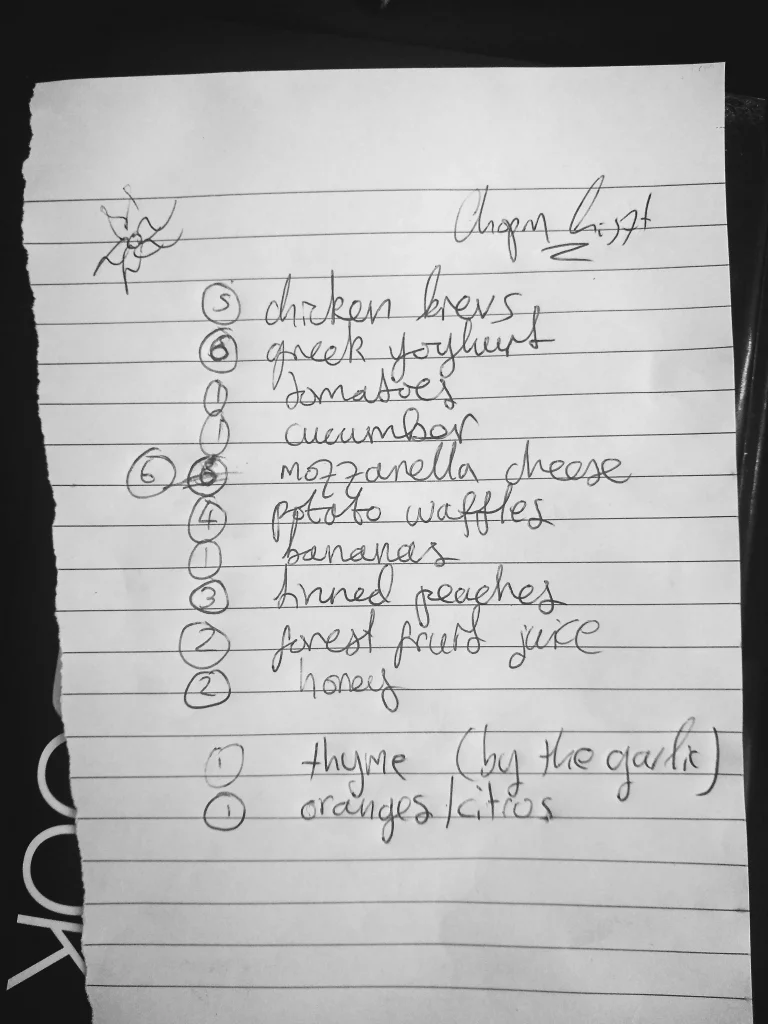

13. Make A Shopping List

Image source RedditSounds simple but it works. If you stick to your list and don't get taken in by 'special offers' of buy 2 get 1 free etc, you will save money. Lots of impulse buys cost you more in the long run as they are not the types of item you would normally use and you will probably stick them at the back of the cupboard. Also, don't shop when you're hungry as you'll reach for the chocolate aisle and will have polished off a bar of Galaxy before you've even started the car engine up. It's empty calories and will have cost you £1.50 ..... and you will have ruined your healthy eating day!

Image source RedditSounds simple but it works. If you stick to your list and don't get taken in by 'special offers' of buy 2 get 1 free etc, you will save money. Lots of impulse buys cost you more in the long run as they are not the types of item you would normally use and you will probably stick them at the back of the cupboard. Also, don't shop when you're hungry as you'll reach for the chocolate aisle and will have polished off a bar of Galaxy before you've even started the car engine up. It's empty calories and will have cost you £1.50 ..... and you will have ruined your healthy eating day!Advertisement

14. Ask For An Email Receipt From Retailers

Image source Daily MailThese days, especially in fashion stores, the assistant will ask for your email address to send you a receipt for your purchase. Always agree as you will receive discount codes and special offer notifications which you might not have known about if you had insisted on a paper receipt.

Image source Daily MailThese days, especially in fashion stores, the assistant will ask for your email address to send you a receipt for your purchase. Always agree as you will receive discount codes and special offer notifications which you might not have known about if you had insisted on a paper receipt.Advertisement

15. Start A Blog

Image source CanvaIf you have an interesting hobby, specialise in a certain subject or are just plain funny about describing everyday events, then turn your talent into money. Look online to see how to start a blog and if it gathers momentum and thousands of followers, advertisers will pay you to advertise on your page. It could end up being extremely lucrative.

Image source CanvaIf you have an interesting hobby, specialise in a certain subject or are just plain funny about describing everyday events, then turn your talent into money. Look online to see how to start a blog and if it gathers momentum and thousands of followers, advertisers will pay you to advertise on your page. It could end up being extremely lucrative.Advertisement

16. Grow Your Own Veg

Image source SagaWe are not asking you to become a full time greengrocer! If you have even a small patch in your garden that could be turned into growing vegetables such as potatoes and carrots (which are fool proof), then get your gardening gloves on and do it. As well as being cheaper than buying, you can pick what you need so won't have shop leftovers to throw away. If you find you are a green fingered guru and your crops are plentiful, sell them to neighbours and friends.

Image source SagaWe are not asking you to become a full time greengrocer! If you have even a small patch in your garden that could be turned into growing vegetables such as potatoes and carrots (which are fool proof), then get your gardening gloves on and do it. As well as being cheaper than buying, you can pick what you need so won't have shop leftovers to throw away. If you find you are a green fingered guru and your crops are plentiful, sell them to neighbours and friends.Advertisement

17. Get Cash Back On Current Account

Image source The GuardianBanks are desperate to hook you in as a new customer. Why not play the system and beat them at their own game? High Street banks will offer you up to £100 to switch over to them as long as you set up 5 direct debits. They offer this reward in the hope of getting you to use more of their services, such as mortgages, overdrafts and savings accounts. It is up to you whether you accept any of these services but if they are better than the ones you are already receiving, then look into it further. You could save a lot of money.

Image source The GuardianBanks are desperate to hook you in as a new customer. Why not play the system and beat them at their own game? High Street banks will offer you up to £100 to switch over to them as long as you set up 5 direct debits. They offer this reward in the hope of getting you to use more of their services, such as mortgages, overdrafts and savings accounts. It is up to you whether you accept any of these services but if they are better than the ones you are already receiving, then look into it further. You could save a lot of money.Advertisement

18. Start a YouTube Channel

Image source Daily MailSimilar to starting a blog but being in front of the camera this time, find something that will interest the masses, whether it's something practical, weird and wonderful or absolutely anything! Once you've got 30,000 followers, which isn't much when the channel is going out worldwide, the advertisers will be banging down your door. You could be rich as well as famous!

Image source Daily MailSimilar to starting a blog but being in front of the camera this time, find something that will interest the masses, whether it's something practical, weird and wonderful or absolutely anything! Once you've got 30,000 followers, which isn't much when the channel is going out worldwide, the advertisers will be banging down your door. You could be rich as well as famous!Advertisement

19. Make Special Offers Work For You

Image source Money Saving ExpertDo not, repeat do not, buy anything on special offer unless you were going to buy it anyway. It's false economy if you purchase something just because it's a good price. If you are supermarket shopping and a regular item you purchase is half price then, yes, buy 2 because you won't need to buy it again next week. If you are looking to buy a large item like a piece of furniture, it is worth finding out when their summer sale starts etc. When clothes shopping, don't be taken in by a half price skirt that doesn't match with anything in your wardrobe. You'll either have to buy a top to go with it or the skirt will be one of those items that never gets worn.

Image source Money Saving ExpertDo not, repeat do not, buy anything on special offer unless you were going to buy it anyway. It's false economy if you purchase something just because it's a good price. If you are supermarket shopping and a regular item you purchase is half price then, yes, buy 2 because you won't need to buy it again next week. If you are looking to buy a large item like a piece of furniture, it is worth finding out when their summer sale starts etc. When clothes shopping, don't be taken in by a half price skirt that doesn't match with anything in your wardrobe. You'll either have to buy a top to go with it or the skirt will be one of those items that never gets worn.Advertisement

20. DIY For Neighbours

Image source Stuff.comIf you are handy with a hammer, a dab hand with the drill or great at gardening, then why not offer these services, or any others you excel at, to your neighbours. It's very worthwhile as you can use your skills to make money at doing something you enjoy. Your 'customers' will be over the moon that their sliding shelf in the living room can stop falling down and take pleasure in admiring their lawn with it's horizontal lines!

Image source Stuff.comIf you are handy with a hammer, a dab hand with the drill or great at gardening, then why not offer these services, or any others you excel at, to your neighbours. It's very worthwhile as you can use your skills to make money at doing something you enjoy. Your 'customers' will be over the moon that their sliding shelf in the living room can stop falling down and take pleasure in admiring their lawn with it's horizontal lines!Advertisement

21. Teach English To Foreign Students

Image source English FirstIf you are interested in teaching English to foreign students, contact your local college. As long as you have 'O' Level or the equivalent in English, then you may apply. You will have to go on a short course and meet certain criteria but, after that, you are good to go. You can pick the times you want to work and it's a great hourly rate.

Image source English FirstIf you are interested in teaching English to foreign students, contact your local college. As long as you have 'O' Level or the equivalent in English, then you may apply. You will have to go on a short course and meet certain criteria but, after that, you are good to go. You can pick the times you want to work and it's a great hourly rate.Advertisement

22. Rent A Room Out

Image source Realtor.comIf your kids have left home and the spare bedroom hasn't been used as a dumping ground then you might think about renting it out. If you choose to let it to a foreign student you will have the advantage of them not being around much during the day time and most evenings. Whoever you choose, you will earn nicely out of it and the person might be good company for you.

Image source Realtor.comIf your kids have left home and the spare bedroom hasn't been used as a dumping ground then you might think about renting it out. If you choose to let it to a foreign student you will have the advantage of them not being around much during the day time and most evenings. Whoever you choose, you will earn nicely out of it and the person might be good company for you.Advertisement

23. Get Paid To Test Products

Image source Product Review MomFind out online which companies are looking for people to test products out. It is usually things like skin care products and toiletries that they require your opinions on. The stuff is delivered to your door and you get to keep it afterwards which saves money in itself. It pays well and once you are on the company's database, they will keep in contact with you for further testing.

Image source Product Review MomFind out online which companies are looking for people to test products out. It is usually things like skin care products and toiletries that they require your opinions on. The stuff is delivered to your door and you get to keep it afterwards which saves money in itself. It pays well and once you are on the company's database, they will keep in contact with you for further testing.Advertisement

24. Bring Your Own Popcorn

Image source Heart RadioGoing to the cinema can be an expensive trip especially if you purchase snacks and drinks before settling down to watch the movie. Popcorn is £4 for a large tub and with fizzy pop and a bag of pick-a-mix, you're looking at a tenner. For only £2 you can bring your own goodies and if you make 6 visits a year, you're saving £50 without even noticing!

Image source Heart RadioGoing to the cinema can be an expensive trip especially if you purchase snacks and drinks before settling down to watch the movie. Popcorn is £4 for a large tub and with fizzy pop and a bag of pick-a-mix, you're looking at a tenner. For only £2 you can bring your own goodies and if you make 6 visits a year, you're saving £50 without even noticing!Advertisement

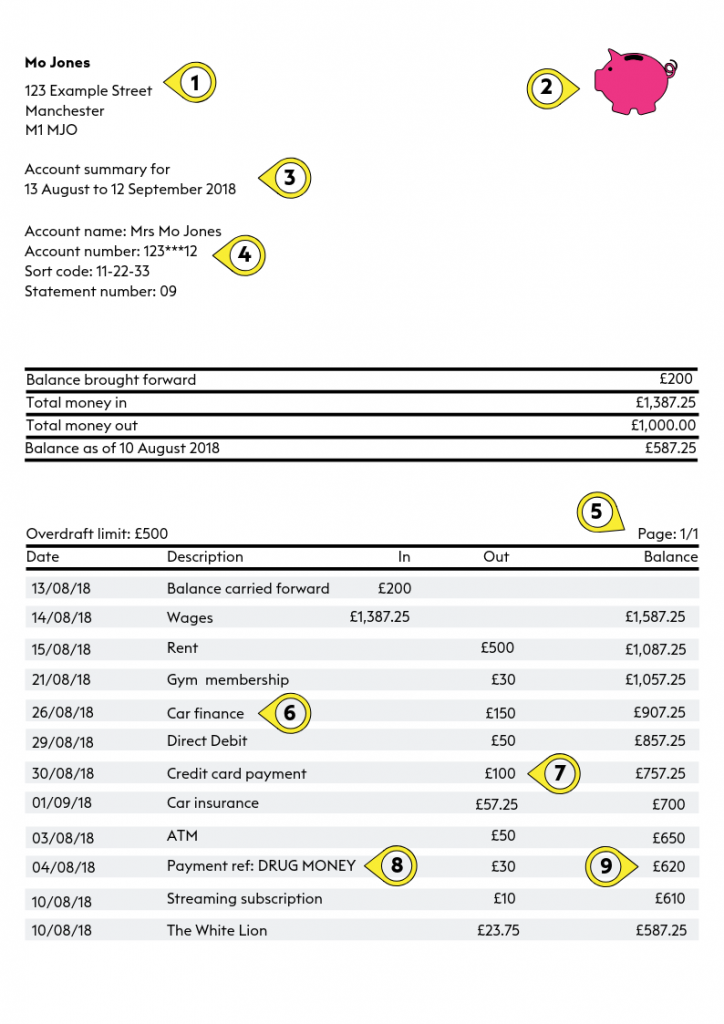

25. Check Your Bank Statement

Image source Mojo MortgagesWe aren't in the habit of checking every transaction on our monthly bank statement but you could save money if you do so. There are likely to be a few direct debits that should have been cancelled and you never got round to it. These are mainly subscriptions that you are no longer interested in or insurances for protection of damage to items you don't even have now. If you have an online account you can cancel them on your phone or tablet in minutes with no need to speak to a person.

Image source Mojo MortgagesWe aren't in the habit of checking every transaction on our monthly bank statement but you could save money if you do so. There are likely to be a few direct debits that should have been cancelled and you never got round to it. These are mainly subscriptions that you are no longer interested in or insurances for protection of damage to items you don't even have now. If you have an online account you can cancel them on your phone or tablet in minutes with no need to speak to a person.Advertisement

26. Ditch A Single Take-Away Coffee

Image source MTPakIf you look forward to a nice, strong Americano from a popular coffee house on the way to work, it will cost you around £2.75. Add this up over a year and we are talking mega bucks. Invest in a flask or insulated heatproof cup, make your coffee at home for pennies and take it with you.

Image source MTPakIf you look forward to a nice, strong Americano from a popular coffee house on the way to work, it will cost you around £2.75. Add this up over a year and we are talking mega bucks. Invest in a flask or insulated heatproof cup, make your coffee at home for pennies and take it with you.Advertisement

27. Paying The Mortgage

Image source The GuardianIf your mortgage provider does not penalise you for paying more than the monthly instalment amount on your mortgage, then go for it. By paying an extra £50 a month you can be mortgage free up to 5 years faster than the original term. If you are shopping round for a new mortgage and have a good credit rating, do your homework online as there are some great deal out there to save you money.

Image source The GuardianIf your mortgage provider does not penalise you for paying more than the monthly instalment amount on your mortgage, then go for it. By paying an extra £50 a month you can be mortgage free up to 5 years faster than the original term. If you are shopping round for a new mortgage and have a good credit rating, do your homework online as there are some great deal out there to save you money.Advertisement

28. Say 'No' To Ready Meals

Image source Daily MailReady meals are convenient but they work out more expensive as they are far less filling than home cooked dinners, meaning you're looking for further food to satisfy your appetite. They are nearly all very high in salt and additives, even the ones that say low fat. Maybe have a half day at the weekend preparing meals for the following few days. You can include leftovers to make new dishes and chop up all the veg that have seen better days and make a filling soup with them. Both your current account and your stomach will be healthier.

Image source Daily MailReady meals are convenient but they work out more expensive as they are far less filling than home cooked dinners, meaning you're looking for further food to satisfy your appetite. They are nearly all very high in salt and additives, even the ones that say low fat. Maybe have a half day at the weekend preparing meals for the following few days. You can include leftovers to make new dishes and chop up all the veg that have seen better days and make a filling soup with them. Both your current account and your stomach will be healthier.Advertisement

29. Treat Your Car With Respect

Image source JCT600Look after your car and you won't receive nasty shocks when you face paying a huge maintenance bill. Check the water and oil every month, never let the petrol go to almost empty and have it serviced and MOT'd every year. Look around for special deals on breakdown cover for your vehicle because if it needs towing away, it will cost you hundreds.

Image source JCT600Look after your car and you won't receive nasty shocks when you face paying a huge maintenance bill. Check the water and oil every month, never let the petrol go to almost empty and have it serviced and MOT'd every year. Look around for special deals on breakdown cover for your vehicle because if it needs towing away, it will cost you hundreds.Advertisement

30. Share Childminding

Image source MadeForMumsChildminding costs eat a chunk out of our salary but we have no choice as we need to feel confident that the little cherubs are safe and happy in an environment when away from home. If you and other mums you are friendly with are working part time, how about doing a rota with them to fit in with work commitments that you all have. Even if you can do this once a week, the savings over a year will be huge.

Image source MadeForMumsChildminding costs eat a chunk out of our salary but we have no choice as we need to feel confident that the little cherubs are safe and happy in an environment when away from home. If you and other mums you are friendly with are working part time, how about doing a rota with them to fit in with work commitments that you all have. Even if you can do this once a week, the savings over a year will be huge.Advertisement